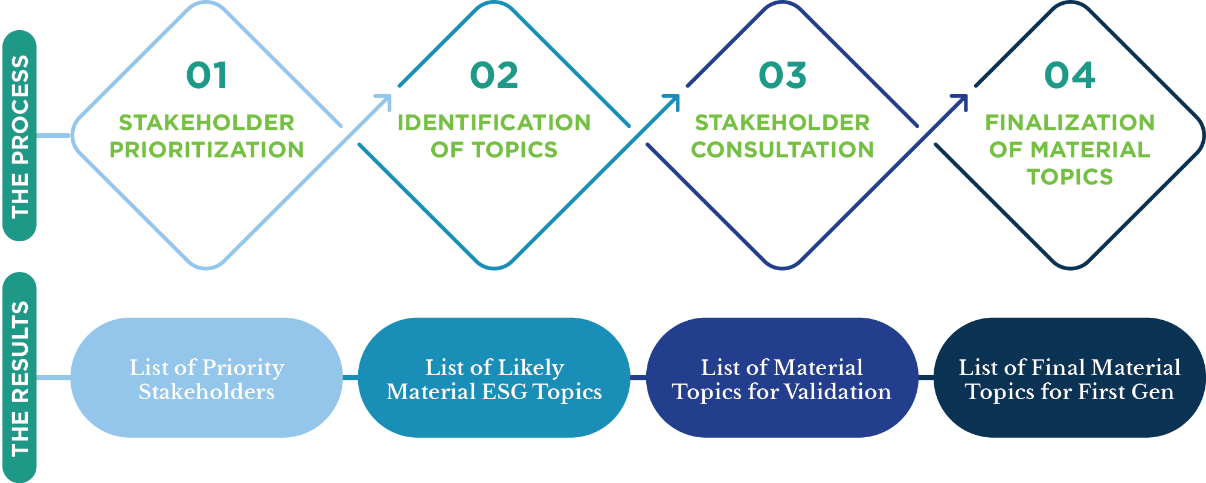

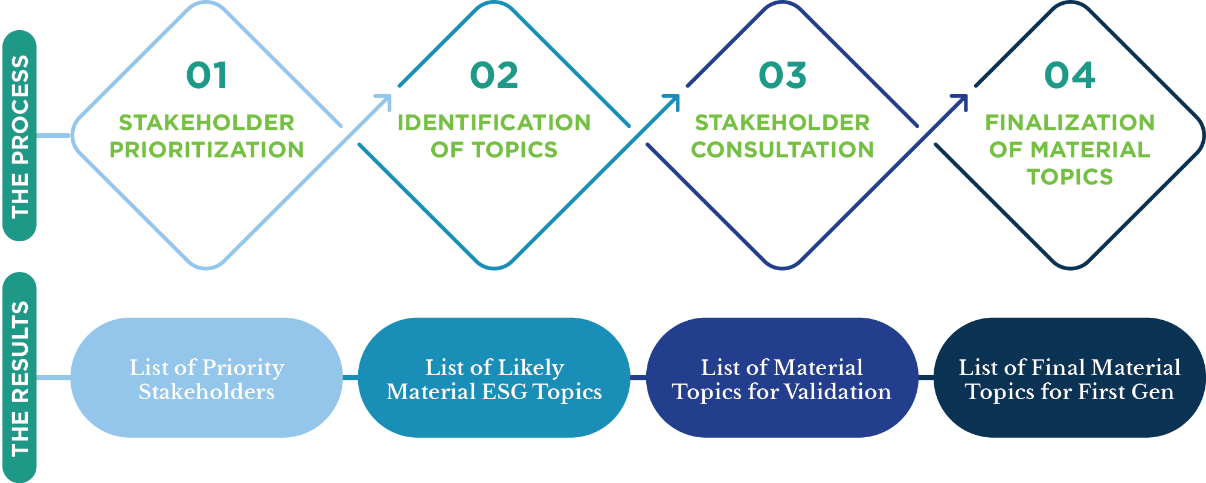

Stakeholder Prioritization

The stakeholders involved in the 2023 materiality assessment represent the individuals or interested groups that are affected or could be affected by the organization’s activities. This perspective helps the Company better determine how to successfully implement our strategies and achieve our goals.

With the support of the departments responsible for stakeholder relations, we identified the list of actual stakeholders. Stakeholders were listed and grouped based on the following criteria: 1) interest, 2) benefit, and 3) contribution to the value created by the Company over time. Each stakeholder group was rated based on 1) how each stakeholder group affected the Company’s capacity to generate value over time, and 2) how the Company affected each stakeholder’s capacity to generate value over time.

The prioritization process determined the inclusion of these stakeholders, listed as follows:

| FINANCIAL STAKEHOLDERS | SOCIO-ECONOMIC AND ENVIRONMENT STAKEHOLDERS |

|---|---|

| Investors | Employees |

| Customers | Government/Regulators |

| Communities/Non-Government Organizations | |

| Vendors/Consultants/Auditors/Training Partners/ Insurance Groups/Media |

Identification of topics

The topics subject to the 2023 assessment cover the entire sustainable business model and are classified into three categories: environment, social, and governance topics.

In defining the ESG topics, multiple sources were considered by UA&P-CSR.

The instruments used include the following:

- the topics of greatest interest to sustainability rating agencies;

- industry benchmarking studies of local and international peers;

- Integrated/Sustainability Reporting standards and frameworks such as GRI, SASB, TCFD, and <IR>.

Stakeholder Consultation

The priorities assigned to the topics were identified through the administration of a survey questionnaire designed by UA&P-CSR. A total of nine consultations covering the internal and external stakeholders from the head office and all plant sites were completed. Overall, there were 232 survey respondents who participated.

The survey questionnaire has each topic identified and rated based on the following:

- impact on Company’s ability to generate financial value

- impact on Company’s key stakeholders

Finalization of material topics by Senior Management

The Sustainability Technical Working Group facilitated the discussion and finalization of ESG material topics with senior management.

After finalizing the list of topics, there were a total of 32 ESG topics (8 Environmental, 13 Social and 11 Governance topics) that the Company considered material and are as found on the table below. Compared to the 2022 Integrated Report, there was only one topic that was not included which was the management of the COVID-19 pandemic. Disclosure related to this topic is under Occupational Health and Safety while an additional four (4) topics were no longer material as a result of the exercise. There are four new topics that made it for the first time on the 2023 final list of materials namely tax, sustainable finance, market presence and indirect economic impacts.

| MATERIAL TOPICS |

KEY INDICATORS | CURRENT IMPACT ON VALUE CREATION |

TIMEFRAME OF IMPACT* |

LINK TO STRATEGY |

LINK TO OUTLOOK |

|---|---|---|---|---|---|

| ENVIRONMENT | |||||

| Materials | Materials used by weight or volume whether from renewable and non-renewable sources |

Decrease in use of materials needed for the power generation process Increase in the use of renewable materials |

Short to Medium Term |

Grow our portfolio to 13GW |

Expanding and upgrading our clean energy asset profile |

| Energy | Energy consumption within the organization |

Decrease in energy consumption that comes from fuel Electricity is a crucial component of our operations. |

Short to Medium Term |

Create Total Stakeholder Value |

Using technical, commercial, and technological improvements to enhance our portfolio’s carbon intensity |

| Reduction of energy consumption | |||||

| Average generation efficiency for natural gas plants | |||||

| Water and Effluents | Total water withdrawal | Decrease in water consumption of our operations particularly in our natural gas and hydro plants. | Short to Long Term |

Create Total Stakeholder Value |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Total water discharged | |||||

| Total water consumption | |||||

| Compliance with water-related regulatory requirements | |||||

| Emissions | Gross direct greenhouse gas (GHG) emissions (Scope 1) |

Decrease in Scope 1 emissions which is the primary byproduct of the power generation process Increase in Scope 3 emissions especially on our fuel-related activities as we started to account for this emission Increase in carbon emission intensity |

Short to Medium Term |

Grow our Create Total Stakeholder |

Expanding and upgrading our clean energy asset profile Using technical, commercial, and technological improvements to enhance our portfolio’s carbon intensity |

| Gross indirect GHG emissions (Scope 2) | |||||

| Gross other indirect GHG emissions (Scope 3) | |||||

| GHG emissions intensity ratio | |||||

| Amount of GHG emissions reductions achieved | |||||

| Programs that reduce, eliminate, or prevent pollution at its source | |||||

| Amount of nitrogen oxides (NOx), sulfur oxides (SOx), and particulate matter (PM), carbon monoxide (CO) and other significant air emissions such as lead (Pb) and mercury (Hg) | |||||

| NOx , SOx, CO, PM, Pb and Hg emission intensity | |||||

| Waste | Total waste generated |

Decrease in total waste generated from our operations and activities Increase in the waste diverted from disposal by composting and recycling of wastes |

Short to Long Term |

Create Total Stakeholder |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Total waste diverted from disposal | |||||

| Total waste directed to disposal | |||||

| Waste generation and significant waste-related impacts | |||||

| Climate Action | Description of the impact associated with the climate-related risk or opportunity and method of management | More resilient infrastructure and reliable operations due to implemented measures to mitigate climate-related risks | Short to Long Term |

Grow our Create Total Stakeholder |

Expanding and upgrading our clean energy asset profile Using technical, commercial, and technological improvements to improve our portfolio’s carbon intensity |

| Long-and short-term strategy or plan to manage Scope 1 emissions | |||||

| Strategies or plans to address air emissions-related risks, opportunities, and impacts | |||||

| Environmental Compliance | Number of incidents of non- compliance with environmental permits, standards, and regulations | Maintain zero environmental non-compliance in our operations and responding promptly to regulatory changes | Short to Medium Term |

Create Total Stakeholder Value |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Biodiversity | Size of restored and protected areas | Sustainment of biodiversity programs that is paramount for the long-term sustainability of ecosystems surrounding your operating assets | Short to Long Term |

Create Total Stakeholder Value |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| List of environmental programs | |||||

| Number of kilometers of foot and drone patrols | |||||

| Number of seedlings generated | |||||

| List of information, education and communication (IEC) advocacies to promote species conservation | |||||

| SOCIAL | |||||

| Employment | New employee hires and employee turnover | Improved quality of service to internal customers, our employees; | Short to Medium Term |

Enable the organization |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement Pushing forward with human capital management development and training |

| Benefits provided to full-time employees that are not provided to temporary or part-time employees | |||||

| Labor / Management Relations |

Minimum notice periods regarding operational changes |

Increased level of employee engagement and experience on "moments that matter" Agreeable working relationships that lead to better productivity and reliability |

Short to Medium Term |

Enable the organization |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Occupational Safety and Health (OSH) |

The number and rate of fatalities, high-consequence work-related injuries, recordable work-related injuries, and hours worked and trend |

Decrease in the number of injuries and illnesses among employees and contractors Prevention of work-related injuries and illnesses due to reporting of near-miss incidents and the implementation of OSH Management System |

Short to Long Term |

Enable the Create total |

Ensuring ESG remains a key priority when it comes to strategy and operation |

| Number of fatalities and cases of recordable work-related ill health | |||||

| Near Miss Frequency Rate | |||||

| OSH audits conducted | |||||

| List of OSH training conducted for employees and contractors | |||||

| Amount invested for implementation of OSH Programs | |||||

| List of CESHM Activities and outcomes | |||||

| List of occupational health services | |||||

| Local Communities |

Operations with local community engagement, impact assessments, and development programs |

Support to the community by implementing health, education, livelihood, environment, emergency response and relief, and socio-cultural programs. Agreeable partnership between the Company and host communities |

Short to Medium Term |

Create total |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Operations with significant actual and potential negative impacts on local communities | |||||

| Amount invested to community per category | |||||

| Supplier Social Assessment |

Number of suppliers that were screened using social criteria | Influencing our suppliers and contractors to ensure fair and just treatment to their workers through our vendor accreditation process | Short to Medium Term |

Decarbonize through securing regenerative partners | Ensuring ESG remains a key priority when it comes to strategy and operation |

| Percentage of suppliers identified as having significant actual and potential adverse social impacts | |||||

| Customer Health and Safety |

Assessment of the health and safety impacts of product and service categories | Maintain zero non-compliance by ensuring that all of our operating plants were designed and operated per Industry health and safety standard. | Short to Medium Term |

Enable the organization |

Ensuring ESG remains a key priority when it comes to strategy and operation |

| Customer Privacy |

Substantiated complaints concerning breaches of customer privacy and losses of customer data | Maintain zero breaches of customer privacy through the implementation of our cybersecurity practices. | Short to Medium Term |

Enable the organization |

Ensuring ESG remains a key priority when it comes to strategy and operation |

| Customer Relationships |

Number of customers per category |

Customers’ appreciation on value added services and increased comprehension on the balance of clean and RE solutions High level of customer satisfaction due to our services and efforts to address their concerns |

Short to Medium Term |

Decarbonize through securing regenerative partners | Consistent re-evaluation and adjustment of our planning calculations and strategies in response to market dynamics and demand |

| Stakeholder Engagement |

Frequency of engagement by type and by stakeholder group | Increased understanding of stakeholder concerns by utilizing various engagement channels to communicate their subjects of interest or concern | Short to Medium Term |

Decarbonize through securing regenerative partners |

Consistent re-evaluation and adjustment of our strategies and solutions in response to market dynamics and demand Ensuring ESG remains a key priority when it comes to strategy and operation |

| List of stakeholder group | |||||

| List of stakeholders’ concerns | |||||

| List of engagement channels | |||||

| Power Supply Availability |

Plant Availability | Despite the technical challenges faced by the Company’s various plants and facilities, some segments have managed to reach or even exceed their goal in delivering reliable electricity | Short to Medium Term |

Grow our portfolio to 13GW |

By growing to 13GW with a bias for RE, we continue to support the country’s growth requirements, with a portfolio driven by clean and renewable energy |

| Plant Reliability | |||||

| No. of hours of forced outage | |||||

| No. of hours of planned outage | |||||

| Human Rights | Employee training and number of hours of training on human rights policies | Respect of human rights lead to productivity and conducive work environment | Short to Medium Term |

Enable the organization Create total stakeholder value |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| List of initiatives and outcomes | |||||

| Number and percentage of operations subjected to human rights review or impact assessment | |||||

| Training and Education |

Average hours of training per year per employee | Improved competency of employees and workers result in increased productivity and efficiency at work, enhanced quality and customer service, and cost effectiveness | Short to Medium Term |

Enable the organization |

Pursuing a customer- centric mindset through training and development Pushing forward with human capital management development and training |

| Programs for upgrading employee skills and transition assistance programs | |||||

| Percentage of employees per category, by gender and age group | |||||

| Diversity and Equal Opportunity |

Total number of incidents of discrimination and corrective actions taken | Increased employee engagement and employer branding by through the various programs and initiatives on equity and inclusion | Short to Long Term |

Enable the organization | Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Percentage of women in leadership positions | |||||

| Employee male to female ratio by rank and age group | |||||

| GOVERNANCE | |||||

| Economic Performance |

Revenues per platform | 92% of First Gen’s total generated economic value was invested into the economy in the form of operating costs, employee wages and benefits, payments to providers of capital, and payments to the Government | Short to Long Term |

Grow our portfolio to 13GW |

By growing to 13GW with a bias for RE, we continue to support the country’s growth requirements, with a portfolio driven by clean and renewable energy |

| Consolidated net income | |||||

| Net income attributable to equity holders of the parent | |||||

| Recurring net income attributable to equity holders of the parent | |||||

| Economic Value Generated | |||||

| Economic Value Invested | |||||

| Economic Value Retained | |||||

| Market Presence | Ratios of standard entry level wage by gender compared to local minimum wage | Maintain high proportion of senior management from local community by prioritizing local hiring with due consideration to local regulations and hiring standards | Short to Medium Term |

Enable the organization Create total |

Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Indirect Economic Impacts |

Infrastructure investments and services supported | Economic and social progress in the regions in which our Company operates, through financial investments intended to upli the lives of people | Short to Medium Term |

Create total stakeholder value | Pursuing ESG-related focus areas such as resource management (water and waste), biodiversity, regenerative business models, host community development, and employee engagement |

| Significant indirect economic impacts | |||||

| Tax | Approach to tax | Compliance with tax laws through the payment of correct and equitable taxes to the tax authorities, which is essential to nation building and economic growth | Short to Medium Term |

Create total stakeholder value | Ensuring ESG remains a key priority when it comes to strategy and operation |

| Tax governance, control, and risk management | |||||

| Innovation | Initiatives developed and implemented, including business units that benefited and their corresponding outcomes |

Effective carry-out of our operations and utilization of other capitals through digitalization and reliable systems Building a culture of innovation and continuous improvement |

Short to Long Term |

Grow our Enable the organization |

Developing systems and processes to facilitate experimentation and innovation |

| Sustainable Finance |

Employment of capital towards the most cost-efficient and high-return projects aligned with our mission | Optimizing value of the investment to achieve growth and income aspirations | Short to Long Term |

Grow our |

By growing to 13GW with a bias for RE, we continue to support the country’s growth requirements, with a portfolio driven by clean and renewable energy |

| Business Ethics and Governance |

Established governance policies and mechanism | By implementing its policies, the Company is able to establish mechanisms whereby integrity and ethical business standards are ensured. Likewise, the policies are the Company’s instruments to support the maintenance and development of its capitals and monitor the organization’s culture | Short to Long Term |

Enable the organization | Ensuring ESG remains a key priority when it comes to strategy and operation |

| Whistleblower protection | |||||

| Oversight for ethics issues and processes for evaluating the performance of the highest governance body in overseeing the management of the organization’s impacts on the economy, environment, and people; | |||||

| Policy commitments for responsible business conduct and respect to human rights | |||||

| Processes to remediate negative impacts | |||||

| List of Corporate Policies | |||||

| Corporate Governance |

Governance structure, including committees of the highest governance body | Strict compliance with corporate governance regulations and continuous improvement on corporate processes to be at par with global best practices | Short to Long Term |

Enable the organization | Ensuring ESG remains a key priority when it comes to strategy and operation |

| Nomination and selection processes for the highest governance body and its committees | |||||

| Role of the highest governance body in sustainability reporting | |||||

| Expertise of governance body including ESG | |||||

| Remuneration policies for members of the highest governance body and senior executives, | |||||

| Risk Management |

Description of key impacts, risks, and opportunities | Sustained implementation of mitigating actions for risks that could result in damage or reduced efficiency of power generation facilities causing capacity to be downgraded, operations temporarily stopped or shut down completely | Short to Long Term |

Enable the organization | Ensuring ESG remains a key priority when it comes to strategy and operation |

| Mitigating actions on risks | |||||

| Description of risk assessment process | |||||

| Data Privacy | Number of violations of the Data Privacy Act | Maintain adherence to the Data Privacy Act through protection of our Company’s data security and stakeholders’ personal privacy | Short to Medium Term |

Enable the organization | Ensuring ESG remains a key priority when it comes to strategy and operation |

| Programs on Data Protection | |||||

| Anti-Corruption | Percentage of operations assessed for risks related to corruption | Enforcing our policy commits to ensuring that all business activities are conducted in an ethical manner | Short to Long Term |

Enable the organization | Ensuring ESG remains a key priority when it comes to strategy and operation |