1. Customers

| STAKEHOLDER | VALUES FOR THE STAKEHOLDER |

VALUES FOR FIRST GEN |

KEY FOCUS AREAS IN OUR ESG STRATEGY |

|---|---|---|---|

|

|

Use of reliable, clean and renewable energy solutions and utilization of value-adding services

Deeper understanding and appreciation of impacts of use of clean and renewable energy solutions |

Recurring revenues from loyal customers and increase in revenues from new customers and new energy solutions offered |

Energy security and resource management |

|

2. Co-creators - Employees, vendors, and partners |

For employees:

Secured sources of employment and livelihood

Development of skills and nurture of well-being

Flexible work arrangements leading to work life balance

For employees, vendors, and partners:

Safe and healthy working conditions

Working environment that respects human rights and promotes fair and just dealings |

From employees:

Attraction and retention of employees/talents and like-minded partners

Qualified and competent employees to deliver value to our customers and other stakeholders

From vendors and partners:

Reliable products and services from vendors to sustain our operations |

Enabling employees |

|

3. Planet |

Increase in the utilization of renewable sources that results in low GHG emissions

Protection of our environment through reforestation and conservation programs |

Continued supply of raw materials from natural resources that lead to continued operations and steady revenues |

Energy security and resource management Preserving ecosystems and biodiversity |

|

4. Host communities |

Improved access to quality education, sustainable livelihoods, and resources that promote climate resilience

Contribution to local economy upswing from our distributed income and expenses

Climate-related and emergency response awareness and readiness |

Granted a social license to operate

Good community relations |

Supporting climate-resilient host communities |

|

5. Investors |

Confidence in the stability of investment and long term value of investments

ESG objectives and commitments of First Gen |

Continued access to financial capital |

Energy security and resource management Developing decarbonized and regenerative businesses |

|

6. Government |

Contribution of First Gen to the government’s sustainable development agenda and to national economic recovery

Response to the high energy demand in the country

Support government’s targets on RE and GHG emission reduction |

Alignment with government’s directives and programs on RE |

Energy security and resource management |

Long Term

Short Term

We continue to monitor and quantify the operational costs and investments in our various capitals with the financial tool that was introduced in 2021. The table below gives an overview of the costs of our resources, activities, processes, programs, initiatives, and tools that protected our capitals and generated value for the Company and our stakeholders.

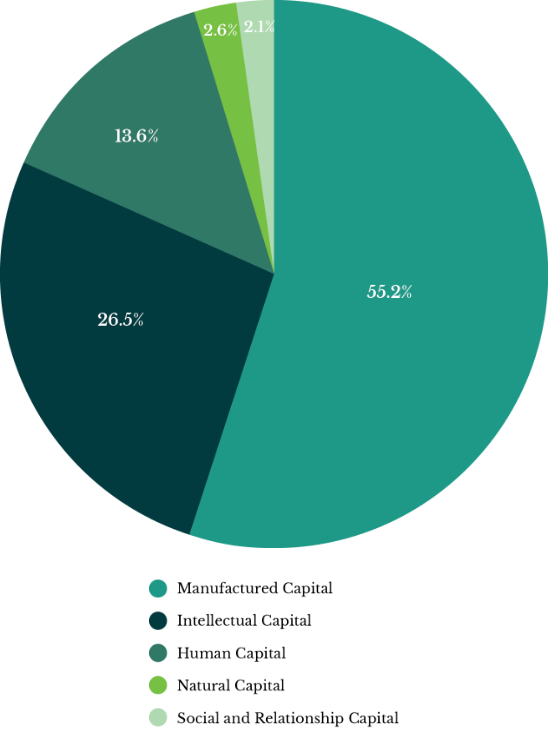

| CAPITALS | 2023 | 2022 | ||

|---|---|---|---|---|

| AMOUNT (IN USD MILLIONS) |

PERCENTAGE | AMOUNT (IN USD MILLIONS) |

PERCENTAGE | |

| Manufactured | 491.4 | 55.2% | 357.3 | 68.8% |

| Human | 120.7 | 13.6% | 123.1 | 23.7% |

| Social | 19.1 | 2.1% | 19.2 | 3.7% |

| Natural | 23.3 | 2.6% | 11.3 | 2.2% |

| Intellectual | 236.2 | 26.5% | 8.2 | 1.6% |

| Total | 890.7 | 100% | 519.1 | 100% |

FIRST GEN'S ESG INVESTMENTS IN 2023

2023 marks First Gen’s largest investment in our Manufactured capital at 55.2 percent. The investment covered the acquisition and construction of our infrastructure, the maintenance and upkeep of our facilities, and the various renovations and improvements made to our buildings and equipment. This also includes the costs associated with remodeling our facilities to accommodate flexible working arrangements and our other investments in building the resiliency of our assets.

Investment in our Intellectual capital has gone up significantly from 1.6 percent in 2022 to 26.5 percent in 2023. This is primarily due to the increase in costs of permits, licenses, and rights to use the infrastructure of the Floating Storage and Regasification Units (FSRU) and tugs for LNG, as well as the prices of the FGPC for its Foreshore Lease and Easement. Other investments under this capital include intellectual property, software and tools, IT systems, cybersecurity, ISO certifications and other accreditations, research and studies, strategy planning, and branding and marketing.

First Gen’s investments into our Human capital in 2023 decreased to 13.6 percent (compared to 23.7 percent overall share in 2022), primarily due to the winding down of our company-wide COVID-19 programs and initiatives. The rest of our investments in this capital are employee-centric and include: salaries and non-medical benefits for employees, skills development, capacity building, and employee engagement events. We have also continued with our vaccination program, occupational health and safety training, medical and mental health programs, and activities targeted at improving overall employee well-being.

Natural capital investments comprise 2.6 percent of our overall ESG investments this year. These investments include land acquisition and maintenance, material resources, environmental research, and projects for efficiency and conservation of energy and water. It also accounts for waste management projects, GHG reduction initiatives, activities related to securing permits for the use of natural resources, biodiversity projects, and environment-related CSR projects.

The remaining 2.1 percent of our investments cover our Social and Relationship capital, consisting of CSR activities, community work, stakeholder engagement, membership fees, the acquisition of local permits, customer and investor-related costs, and other philanthropic works.

In order for First Gen’s mission to thrive, the Company shall continue to embed the capitals in our businesses and operations. At the same time, we will be moving forward with the careful monitoring of these capitals and ensuring that they work together to achieve our goals. First Gen will press on to efficiently utilize these capitals to guarantee value creation and preservation not only for the Company, but also for our customers, co-creators, communities, investors, regulators, and the planet.