Dear Stakeholders,

The year 2023 depicts a picture of irony. While the climate crisis rages on, we at First Gen made significant headway on our decarbonized and regenerative mission. We continued to execute our strategic and operational initiatives and delivered solid financial results. It’s a disorienting, uncomfortable reality where we have achievements worth being proud of, yet are set against the backdrop of persistent environmental, social, and economic threats.

Every year, new horrors are brought to life: wildfires raging in the West; super typhoons battering those like us in archipelagic countries; and record-breaking temperatures scorching the globe. Sadly, the most vulnerable populations are unfairly hit the hardest.

This growing climate threat has catapulted humanity into “the era of global boiling ”— borrowing the words of UN Secretary-General António Guterres. May 2023 presented the highest heat index on record for the year, with several days classified as “dangerous ” by PAGASA (Philippine Atmospheric, Geophysical and Astronomical Services Administration). Several locales experienced scorching heat indexes in the 42 to 51 degrees Celsius range. Shortly after, the country was hit by Super Typhoon Egay (international name Doksuri) in July, battering the agricultural sector in the northern Philippines with gusty winds of up to 240 kilometers per hour.

In the face of multiple crises, carrying our mission feels like Sisyphus’ tiresome task of pushing a boulder uphill only for it to drop back down and then having to start over. UN Secretary-General Guterres’ message reminds us that while there is progress, current practices are not enough to address the climate crisis. Scientists have long been warning us of the irreversible progression and what actions must be taken to prevent further catastrophe. We actually know what needs to get done.

Climate solutions must be tailored to a country’s individual context. Our unique scenario makes us ask: how do we decarbonize in a just manner while addressing the need for energy security?

Countries like the Philippines are constrained with limited fossil fuel reserves (Malampaya natural gas supply has been in decline and most of our country’s coal needs are imported from Indonesia). This is an ironic blessing given the Government’s policy to decarbonize the country’s energy systems. Indigenous, renewable sources of energy—be it geothermal, solar, wind, or hydro—can be readily tapped given the right policies and incentives. Intermittent solar and wind in combination with battery storage is one of many logical solutions as their costs to build drop making them even more affordable. Countries like the Philippines are constrained with limited fossil fuel reserves (Malampaya natural gas supply has been in decline and most of our country’s coal needs are imported from Indonesia). This is an ironic blessing given the Government’s policy to decarbonize the country’s energy systems. Indigenous, renewable sources of energy—be it geothermal, solar, wind, or hydro—can be readily tapped given the right policies and incentives. Intermittent solar and wind in combination with battery storage is one of many logical solutions as their costs to build drop making them even more affordable.

First Gen’s response to energy security requires a method of mindfulness. As reported in last year’s annual report, the Department of Energy released an updated Philippine Energy Plan 2020 to 2040 in 2023 (PEP) that outlines the national goal of 35 percent renewable energy power generation by 2030 and 50 percent by 2040. For First Gen to make a difference and be relevant, it will need to grow its portfolio by almost four times from the current 3.5GW to as much as 13GW by 2030. Given the Government’s coal moratorium, the PEP indicates supply growth to come primarily from renewable energy combined with additional gas-fired plants. This is very much consistent with First Gen’s current portfolio and capabilities. And even if the Government’s timeline seems optimistic or unrealistic, First Gen nonetheless needs to possess the capability to pursue numerous projects simultaneously in an agile manner. In other words, we will need to be ready to go when the opportunity presents itself.

First Gen's response to energy security requires a method of mindfulness.

Some of First Gen’s 2023 noteworthy activities and achievements were as follows:

- First Gen’s gas-fired portfolio continued its steady supply of electricity to its customers but needed to address its long-term fuel supply risk. This risk was addressed by securing for itself a continuing supply of natural gas from Malampaya despite its decline. Gas supply will be supplemented with imported LNG upon the completion of the LNG regasification terminal. With the eventual expiry of its power sales agreements, First Gen is now more solidly positioned to recontract the output of the plants to sustain the value of the gas portfolio.

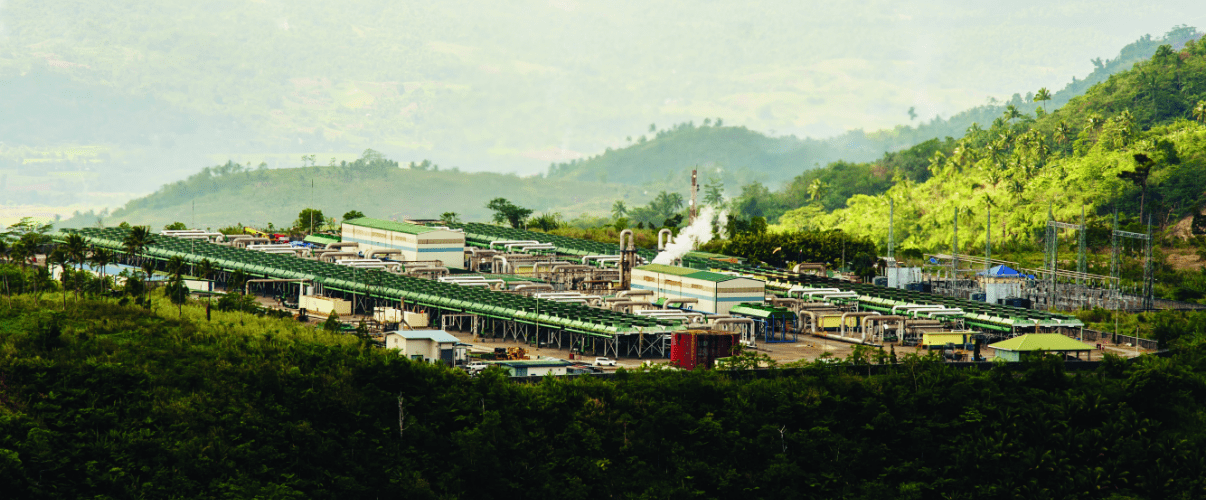

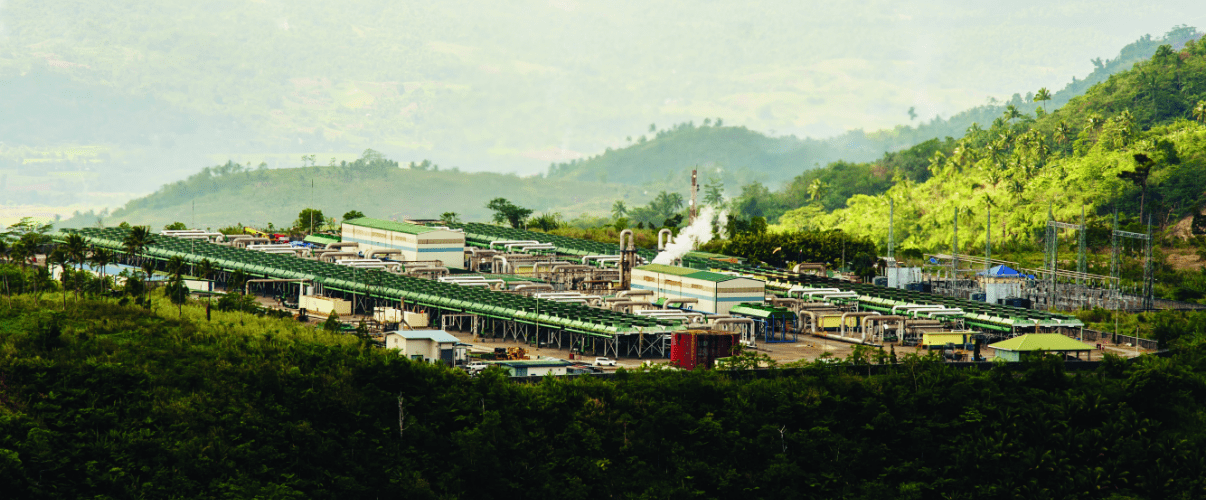

- First Gen’s geothermal subsidiary, EDC, is scaling up its well drilling campaign that will require it to undertake an extensive 40-well drilling program over the next three years. This will supplement the steam requirements for its expanding power generation fleet to deliver the increasing demand for 24-hour baseload renewables to its customers.

- First Gen competed for and won the bidding for the 165-MW Casecnan hydroelectric plant as part of the Government’s privatization plan to deliver more renewable electricity to its growing customer base.

We are pleased to report that after more than ten years of careful planning and intensive development effort, First Gen completed the construction and commissioning of its landmark LNG regasification terminal in the First Gen Clean Energy Complex in Batangas City. At an estimated cost of USD370 million, this strategically important infrastructure, comprising a totally reconfigured multipurpose offshore jetty and the BW Batangas floating storage regasification vessel (FSRU from BW Resources of Norway), assures the Philippines of its needed natural gas supply for First Gen’s existing plants and potentially additional gas-fired power facilities as needed in the future.

First Gen successfully received its first LNG cargo delivery at Subic in August 2023 and completed subsequent deliveries of LNG cargoes in its Batangas complex in December 2023 and February 2024. First Gen has established a track record of buying spot LNG cargo in the international market and is currently in discussions with key players for succeeding LNG cargoes to supplement Malampaya in the medium to long term.

First Gen’s current gas-fired power plants comprising Santa Rita, San Lorenzo, San Gabriel, and Avion have been tested to run simultaneously on Malampaya and regasified LNG with varying specifications to ensure continuity of energy production for its customers. The Santa Rita and San Lorenzo plants comprising six 250+ MW units have the added unique technical benefit of being triple-fuel capable (with Malampaya, LNG, or liquid fuel, if necessary). LNG will also pave the way for the potential expansion of the two by 600-MW Santa Maria project to address the country’s future power needs. In addition, First Gen continues to collaborate with the Department of Energy and the new Malampaya SC38 operators to shepherd the remaining production of domestic natural gas as it steadily declines. As part of its fuel supply strategy, First Gen signed a 15-year terminal lease agreement with Gas Aggregator Philippines Inc. of Prime Infra for gas aggregation services and terminal tolling arrangement subject to mutually satisfactory commercial terms and conditions.

We are also reinforcing our ability to supply more 24-hour baseload geothermal energy through First Gen subsidiary, EDC. Significant effort is being undertaken by EDC to increase its geothermal capacity through a major 40-well drilling campaign over the next three years till 2026. This commitment will require EDC to mobilize six drilling rigs (from the usual two) to be operating simultaneously. We will see four drilling rigs operating in our largest concession in Leyte. EDC is also building 83MWs of new geothermal power plants in Leyte, Bacman, and Negros as well as 40 MWh of Battery Energy Storage System (BESS) in the same locations to be commissioned in 2024.

In addition, First Gen increased its ability to supply renewable energy to its growing customer base when it won the competitive bid for the 165-MW Casecnan hydro power plant in May. In November, it closed a PHP20 billion term loan with BDO and BPI to partially finance the USD526 million acquisition cost. The project was successfully turned over by PSALM to First Gen in February 2024. The Casecnan plant and First Gen ’ s 135-MW Pantabangan-Masiway hydroelectric plant perform synergistically by making use of the large water storage capacity of the Pantabangan reservoir. A plan to construct the 100-MW Aya pumped storage hydroelectric plant in the same area will create a unique and flexible 400-MW total combined hydroelectric facility. In time, we hope to transform the entire site into a RE hub that also integrates other types of renewable sources to benefit First Gen ’ s growing renewable energy portfolio.

First Gen increased its ability to supply renewable energy to its growing customer base when it won the competitive bid for the 165-MW Casecnan hydro power plant in May [2023].

2023 was a financially impressive year for First Gen, reporting a 22% increase in consolidated net income of USD449 million from USD370 million in the previous year. Attributable recurring net income for 2023 of USD277 million (PHP15.4 billion) increased by 4% in comparison to USD265 million (PHP14.3 billion) in 2022. EDC’ s geothermal portfolio delivered record earnings from its high operating income owing to an improvement in electricity prices. The Parent likewise contributed to the higher 2023 income as it benefited from higher interest income due to high yields from its internally generated cash.

The Company reported USD2,475 million (PHP137.7 billion) in revenues for 2023, a 7% decrease of USD192 million (Php 6.4 billion) from USD2,667 million (PHP144.1 billion) from 2022. The slightly lower revenues are a result of a decrease in revenues across all the platforms. The decline is mostly attributable to lower fuel revenues, which is passed-thru in the form of lower electricity prices for consumers. There was a drop in natural gas and liquid fuel prices globally. There was also lower electricity output sold by the natural gas platform. EDC and First Gen Hydro Power Corporation also had lower sales volumes though partly offset by higher average selling prices. The natural gas portfolio accounted for 65% of First Gen ’ s total consolidated revenues while 32% came from EDC’ s geothermal, wind, and solar plants. The remaining balance comes from the Company ’ s hydro plants and the Parent.

The natural gas platform reported a 5% decrease in recurring earnings for 2023 to USD184 million (PHP10.25 billion) from USD190 million (PHP10.28 billion) in 2022. The 420-MW San Gabriel Power Plant (San Gabriel), as well as the 97-MW Avion Power Plant (Avion), enjoyed higher recurring earnings due to the full availability of both plants for the period and lower fuel costs. Both the 1,000-MW Santa Rita and 500-MW San Lorenzo Power Plants earned lower net income mostly due to the incurrence of elevated interest expenses.

FGEN LNG, the Company ’ s incorporated special purpose vehicle for the operations of the Interim Offshore Terminal (IOT) started to generate commissioning revenues from its pre-commercial operations activities. (It likewise booked a receipt of USD25 million in non-recurring other income from construction delay claims.) FGEN LNG generated revenues of USD8 million and a recurring net loss of USD20 million in 2023.

EDC’s recurring earnings at USD119 million (PHP6.6 billion) for 2023 was 24% higher than its recurring income of USD96 million (PHP5.2 billion) in 2022. The geothermal power plants under EDC enjoyed higher sales and operating income as they benefited from an increase in electricity prices. Furthermore, EDC had fewer purchases of replacement power due to lower contracted volumes from the expiry of the Unified Leyte PPA in 2022. The 150-MW Burgos Wind Project likewise continued to benefit from an improved wind regime in 2023.

The hydro platform ’ s contribution to First Gen ’ s recurring earnings was at USD4 million (PHP212 million) for 2023, a 23% decline from its 2022 recurring income of USD5 million (PHP267 million). The Pantabangan-Masiway power plants had a reduction in the volume of electricity sold due to the transfer of its power supply contract to EDC last August 2022, as well as low water reservoir levels. The decrease in electricity sold was mostly offset by an increase in WESM volumes sold and lower purchases of replacement power. The decline was likewise buffered by savings in administrative expenses and higher interest income.

Over a third of First Gen ’ s portfolio is currently composed of geothermal sources. Dating back to 2007, we foresaw the country’s need for clean power. Our capability to grow our clean energy portfolio requires integrating different technologies across varying energy sources to enhance the overall value of a portfolio. Geothermal energy, together with solar, wind, and hydroelectric energy sources, must be harnessed in a way that protects the environment at the same time.

Based on available data from previous years, First Gen is a leading producer of renewable energy in terms of electricity generated. In 2023, our renewable energy portfolio alone generated 7,680.4GWh of RE, which mostly came from our geothermal capacity as the only renewable energy source that can run 24/7. We own and operate the largest integrated geothermal operations in the country, which, combined with the rest of our portfolio, enables us to lead the industry in terms of the energy generated by our RE portfolio.

While we are committed to increasing our renewable portfolio, we are also aware of the various challenges that remain to expand renewables on a standalone basis. It was so important for First Gen to invest in the LNG regasification terminal to secure the fuel needs of our gas portfolio to deliver low carbon electricity to our customers whenever they need it. This unique combination of geothermal with gas technology as part of our portfolio will provide a clear pathway for First Gen to invest in intermittent solar and wind projects as part of a growing renewable- focused portfolio. This is a unique value proposition that we offer our customers.

Despite the many accomplishments, there are still so many things that need to get done strategically and operationally.

Key strategic themes are as follows:

- We need to secure the value of First Gen ’ s portfolio by engaging with key stakeholders, including customers, suppliers, policy makers, and regulators. Our goal is to not only protect but enhance the uniqueness of First Gen ’ s clean and renewable portfolio combined with value added services.

- We need to optimize First Gen ’ s contracting approach by securing customers of our value proposition at cost competitive prices.

- We need to create additional opportunities for First Gen to grow its clean and renewable portfolio to be ready to proceed with projects that are lined up as the demand of electricity grows with the growing economy.

- We need to accelerate the ability for customers to choose where they purchase their electricity needs from as open access competition progresses.

Key operational priorities are as follows:

- We need to begin optimizing the value of the newly-acquired Casecnan hydro plant.

- We need to focus on the steady execution of EDC’ s extensive well-drilling program.

- We need to stabilize the operational and commercial arrangement of the gas supply and LNG operations to address the requirements of the First Gen-owned gas-fired power plants.

- We need to prepare the San Gabriel plant’ s commercial options (which includes short- and/or long-term contracting, ancillary service provider and WESM trading) for its next phase after the expiry of the power supply contract with Meralco in February 2024 and after it completes its 45-day scheduled major maintenance program in time for the hot summer months.

- We need to move ahead with the feasibility and development of First Gen ’ s other wind, solar, hydro, and geothermal service contracts as part of its growth initiative to build towards our 13-GW aspiration.

As the urgency of the climate crisis intensifies, a growing number of customers are specifically sourcing affordable, renewable energy to address their operational and decarbonization ambitions. First Gen ’ s ability to serve this growing customer base will solidify its role as a trusted advisor and partner in their pathway to zero.

At the heart of First Gen lies our customers—our first and foremost priority. Meeting energy demand while keeping to our Mission— “To forge collaborative pathways for a decarbonized and regenerative future ”—is critical to our success. We are committed to our role in shepherding the growth of the country ’ s energy sector in a sustainable direction while continuing to provide our customers with reliable and clean energy solutions.

I firmly believe that the Philippines ’ journey towards a decarbonized and regenerative future is just starting, and I hope that First Gen’ s actions will steer the country towards that future.

Thank you once again for your continuing support.